Global Trade in Services to Increase by $2trn Over Next Five Years, According to New Report by Western Union and Oxford Economics

Forecasts by Western Union and Oxford Economics project

the value of international, cross-border trade in services

rising from $6.1trn in 2019 to $8.0trn by 2025 – a 31%

increase in value

Amongst developed economies, USA, France, and UK set to

see largest increase in value of cross-border trade in

services by 2025

Adoption of new technology and digitization of working

practices likely to further fuel post-pandemic economic

recovery and growth of cross-border trade in services

Trade policy liberalization could see an additional $890bn

increase in the value of services traded globally

The Western Union Company (NYSE: WU), a leader in

cross-border, cross-currency money movement and

payments, today launches a new report, “The Global

Services Trade Revolutions: Fuelling post-pandemic

economic recovery and growth,” in partnership with Oxford

Economics – a leader in global forecasting and quantitative

analysis.

The report projects the value of international trade in

services* rising from $6.1trn in 2019 to $8.0trn by 2025,

equating to an increase of almost a third (31%) in the

value of global flows over this period.

It is predicted this growth will be accelerated by the

adoption of new technology and digitization of working

practices forced by the onset of the COVID-19 pandemic –

which, combined with a shift in attitudes to online

interactions, is likely to fuel economic recovery and growth

of cross-border trade in services in the coming five years.

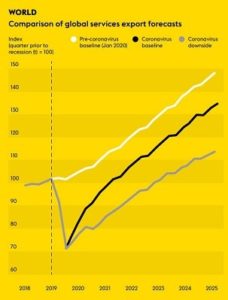

Western Union Business Solutions and Oxford Economics’

central forecast scenario envisages a relatively strong

economic recovery, but it is also possible that a more

pessimistic scenario will unfold, characterized by a steeper

near-term contraction and a more prolonged and

incomplete recovery (see Comparison of global services

export forecasts graph). Still, this scenario would only

magnify the relative outperformance of digitally-deliverable

services.

“For far too long the global service industry has been

undervalued and its importance underestimated. This

report shows that this needs to change. The economic

impact of COVID-19 will be felt for years to come, but we

can clearly see that the regions and industries that

recognize and appreciate the value of global services will

be in a better position to drive future success and

ultimately, recovery,” said Andrew Summerill, President,

Payments at Western Union.

Sector breakdown

The analysis suggests while the global economy is suffering

in the short-term, trade in modern digital services will

prove comparatively resilient through the current crisis. It

estimates that the value of cross-border flows of B2B, ICT

and financial services will decline by just 6% in 2020,

compared to the value of goods trade, which will decline an

estimated 13% (see 2019-2025 Predicted growth in

international services trade graph).

Meanwhile, hard-hit traditional services categories such as

tourism will decline by around 40% in 2020, while air

passenger transport will decline by over 50%. As a share of

total services trade, these categories are projected to slide

to 39% by 2025 – down from 41% in 2019.

Geographic breakdown

The report also analysed these trends across eight large

developed economies, finding B2B services will be the main

driver of export growth, with financial services also

important for key hubs like the USA, UK, Hong Kong and

Singapore. Outside this sample, other predicted ‘hotspots’

for digital services export growth over the medium term

include Korea and Japan, Australia and New Zealand, and

Qatar and Saudi Arabia.

The USA will post the largest overall increase in services

exports during the forecast period, the result of its global

leadership in many categories of professional services, as

well as its investments in digital infrastructure and

technological innovation (see 2019-2025 Predicted growth

in services exports by country).

Furthermore, it is estimated a broad, multilateral

liberalization of trade policies on services could provide an

additional 11% boost to the value of global services trade

by 2025, which would equal an $890bn increase in the

value of these cross-border transactions.

“The pandemic has already super-charged the growth in

digital services and highlighted the potential for remote

services to transcend global borders. Over the next decade,

we’re going to see swathes of new business models

redefine the possibilities for cross-border transactions. And

in the short-term, global trade in services will be a vital

component of recovery, and it will be digitally focused

industries that will be the driving force,” added Summerill.

The report, which aims to shine a light on the valuable

contribution that global digital services trade brings to the

economy now and its potential for the future, uncovers that

trade in services has typically been undervalued, when

compared to trade in goods or manufacturing.

The report estimates that services currently account for

more than half (55%) of all global trade flows, equating to

US$13.7trn of cross-border transactions in 2019. Official

statistics state that the share of services in total trade

amounted to 24% in 2019, up from 19% in 1995.1

“Our aim is to champion the industries fuelling economic

growth and recovery and to provide support to boost the

growth of the digital services sector,” concluded Summerill.

To access the report in full, please click here.

Note on research and methodology

The key framework in which Oxford Economics’ analysis is

conducted is its own Global Econometric Model (GEM). The

GEM replicates the world economy by interlinking 80

countries, 6 regional trading blocs and the Eurozone. These

countries are interlinked through international trade in

goods and services, competitiveness (measured by unit

labour costs adjusted for the exchange rate), capital

markets, interest rates and commodity prices. Historic data

and forecasts are updated on a monthly basis by our

country economists.

*Definitions of international trade in services used for this

study:

Business-to-business (B2B) services: Professional services

(e.g. engineering, legal) and royalty & license fees (e.g.

fees for the use of patented technology).

Information and communications technology (ICT)

services: Services related to computers (e.g. software

development) and communication devices (e.g. telephone

services).

Financial services: Activities of the finance industry

including banking, insurance and asset management.

Transport & distribution: Services related to the

international movement of goods (e.g. shipping, air cargo

and cross-border road & rail transport) or transport of

people (e.g. air passenger services).

Tourism & travel: Spending by temporary visitors to

another country for leisure, business or other purposes

such as education or medical tourism (exports are defined

as inbound tourism flows).

Construction: Services relating to the

construction/demolition of buildings and other structures,

as well as installations and building repairs.

Public services: Services commissioned by the public sector.

التكنولوجيا وأخبارها بوابة الإمارات لتكنولوجيا المعلومات والإتصالات

التكنولوجيا وأخبارها بوابة الإمارات لتكنولوجيا المعلومات والإتصالات